In these uncertain and volatile times for financial markets it is hard for all investors not to feel the fear of stock market uncertainty. The famous Warren Buffett quote resonates well at this time. ““Be fearful when others are greedy, and be greedy only when others are fearful.”

Volatility in the markets

It is easy to follow the crowd and listen to advice from armchair experts to sell now and buy back later but in truth we have to have an iron stomach and believe in stock markets and their ability to bounce back. History tells us that this will be the case and for every stock market crash there has been, there has also been a recovery and the only question is how long will it take?

The graph below from FE Analytics shows the performance of the S&P 500 since 1998, this illustrates that there are always falls but that the markets and the companies that make up these markets have always found a way to recover and bounce back.

What should I do? Stay the course and keep faith in the markets!

During these times it can be tempting to try and “Time the Market” which means sell out of the market at the best possible time (market at its peak) and buy back in when the market is at its lowest but this has proved close to impossible. There is a reason that it is said that “time in the market is better than timing the market”

The table below details the last several bear market drawdowns dating back to 1987 in the US S&P market. While there are huge media stories on the market downturns (in red), what’s less discussed is the performance of the 12 months following on from these “crisis points”. Many of the best all-time trading days in stock markets come within a month of the worst trading days, and being in cash while these best days occur can have a material impact on long-term performance.

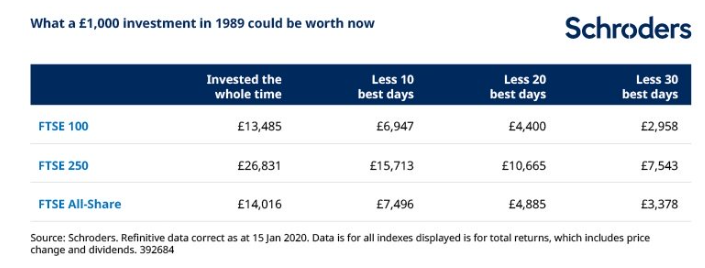

A Schroders review

A Schroders review in January of this year shows the impact of staying in the market versus missing the best 10 days, best 20 days and best 30 days since 1989 and this highlights the dangers in trying to sell out of the market and buy back in when you think the time is right.

A Well Diversified Portfolio

If we have constructed a portfolio for you then we will have diversified this portfolio across a number of geographical regions, asset classes and sectors to try and reduce the effect of volatility on your portfolio. As per the table below from FE Analytics we can see the power of diversification in helping to shield some of the losses at a time like this when nearly all markets are showing large losses.

A large level of diversification should also be useful when trying to make the most of the inevitable stock market recovery. This table shows the current asset, sector and region allocation in our Willis Risk Level 4 Portfolio.

What to do now?

Markets will undoubtedly remain highly volatile in the coming weeks and months but as per the above we would advise to remain invested at these volatile times. For those who need money we can advise you on where best to take money out of your portfolio to make sure you don’t crystallise a loss and for those who do not need money from their funds we would advise you do not take money from these or make moves to cash but instead ride the difficult stock market roller coaster on this dip and allow time for your funds to recover.

Some higher risk investors may also see this as a buying opportunity to put more money into investments as the stocks are significantly cheaper than they were 3 months ago and we are happy to discuss this with you.

We hope this has provided you with some clarity on the markets and the current volatility but more than that we hope that all remain healthy!

To find out more about our Services please contact our team today on T. +44 (0) 28 9032 9042 or fill out the form below: